Business Insurance Cost The Cost Of Public Liability Insurance Ranges From £50 To £500 For A Small Business, And Depends On Factors Like.

Business Insurance Cost. The Cost Of Insurance For Your Business Ultimately Depends Upon A Few Factors.

SELAMAT MEMBACA!

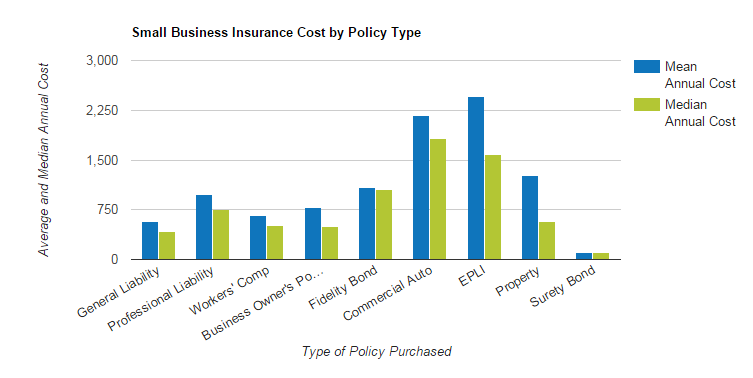

How much does small business insurance cost?

How business insurance costs are calculated.

The insurance company's number crunchers start simply put, the cost of your insurance will depend on what your business does and how much of it.

Get a quote for the type of business insurance that's right for you, including coverage for whether you're a small business just getting started or just looking for better insurance rates, geico can help.

The cost of public liability insurance ranges from £50 to £500 for a small business, and depends on factors like.

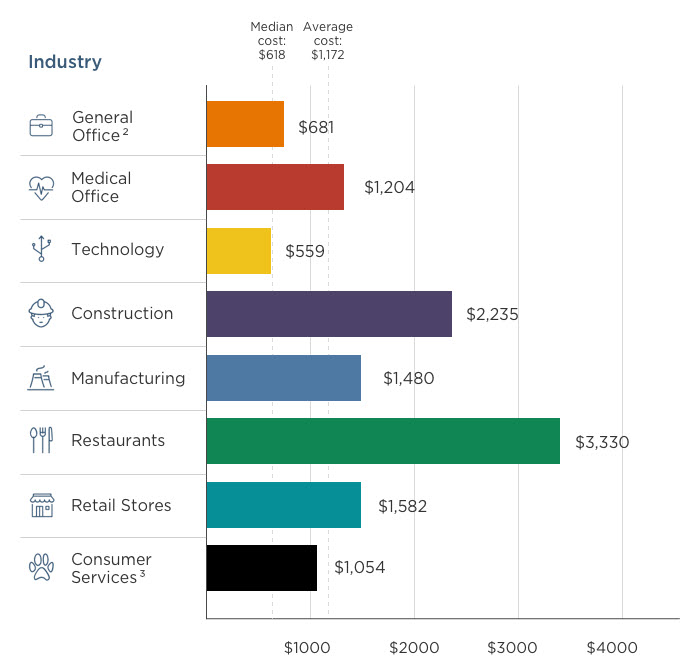

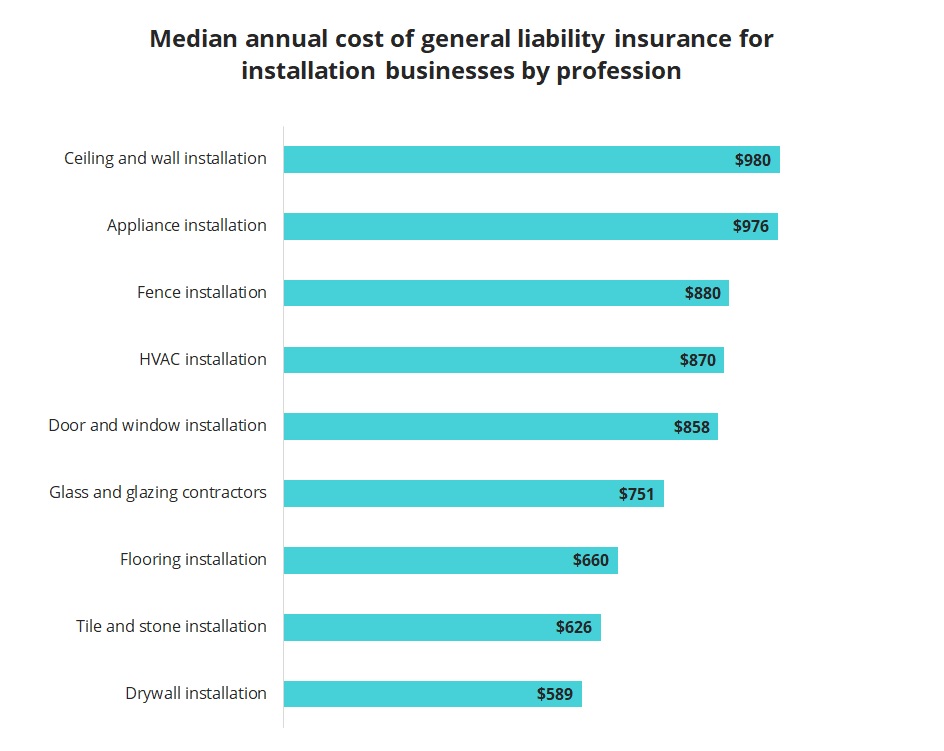

Business insurance costs can vary greatly based on the type of business you own.

Industry type, public visibility, business location and other factors may also contribute to the cost of business.

Rates start at $50 monthly for.

Compare online & save in few simple steps 2.

How much does business insurance cost.

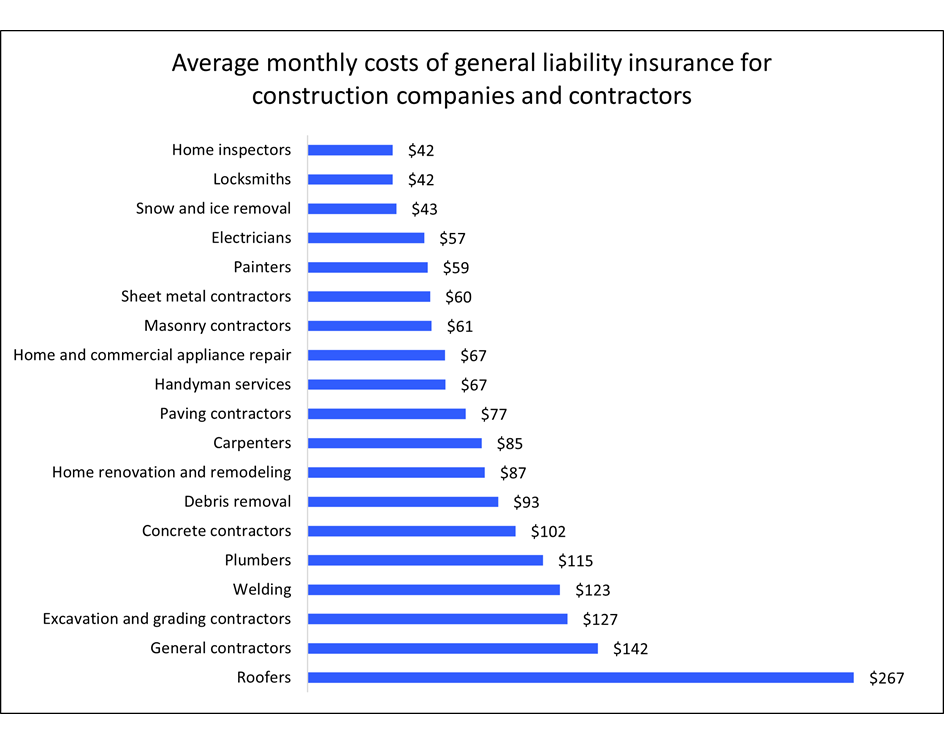

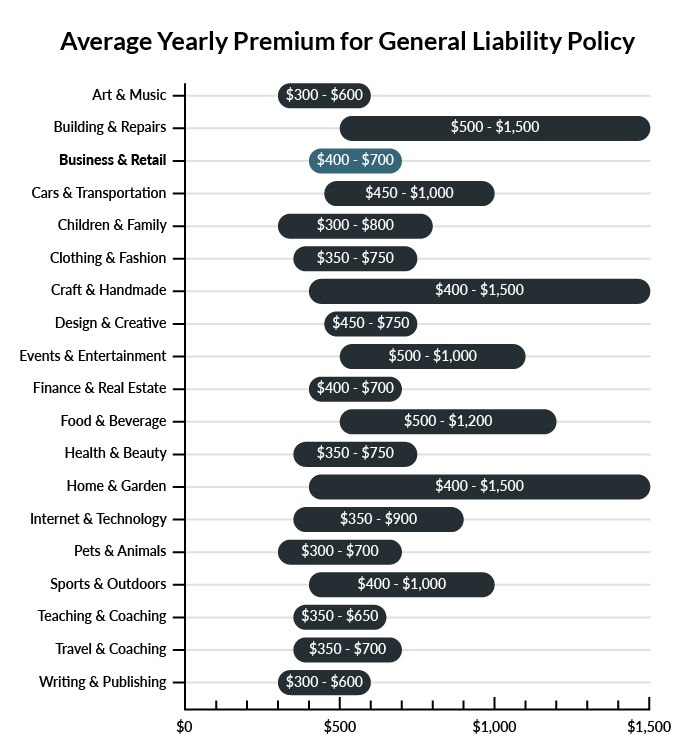

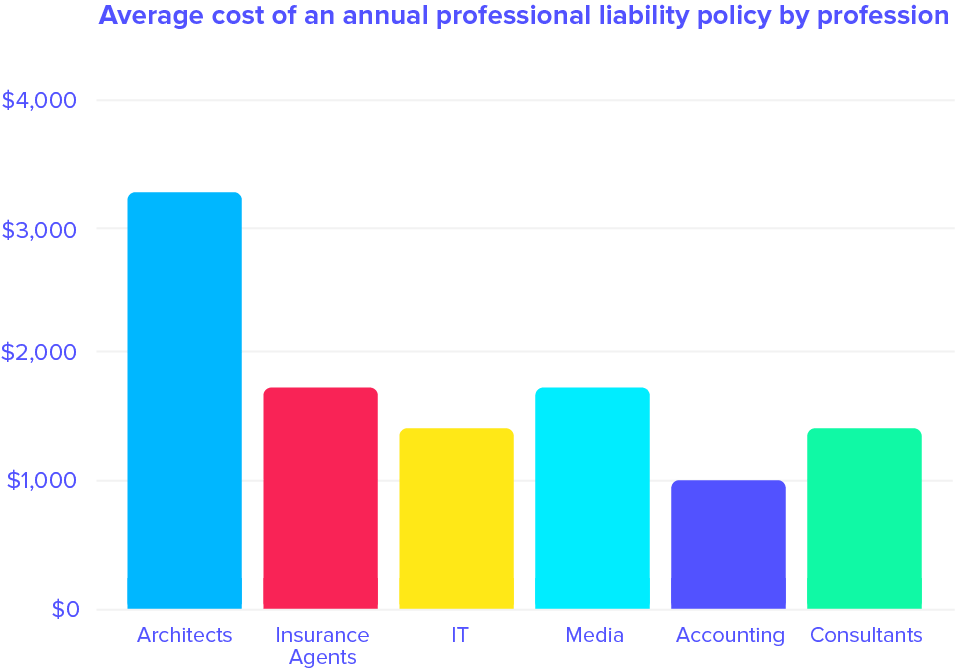

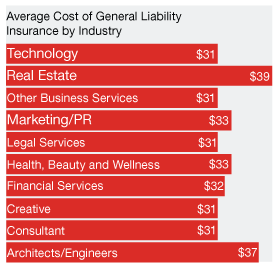

Average cost of business insurance by profession.

The cost of business insurance can be affected by a few different things.

Let's go over each of the most prominent factors in business.

Here's what you need to know before you purchase insurance.

Tailor your business insurance to meet your needs.

With axa, get cover as unique as your so as you might expect, the cost of your business insurance will be unique too.

But the cost of business insurance is usually driven up by your business liability cover:

Covers your business in case any current or previous employees become injured.

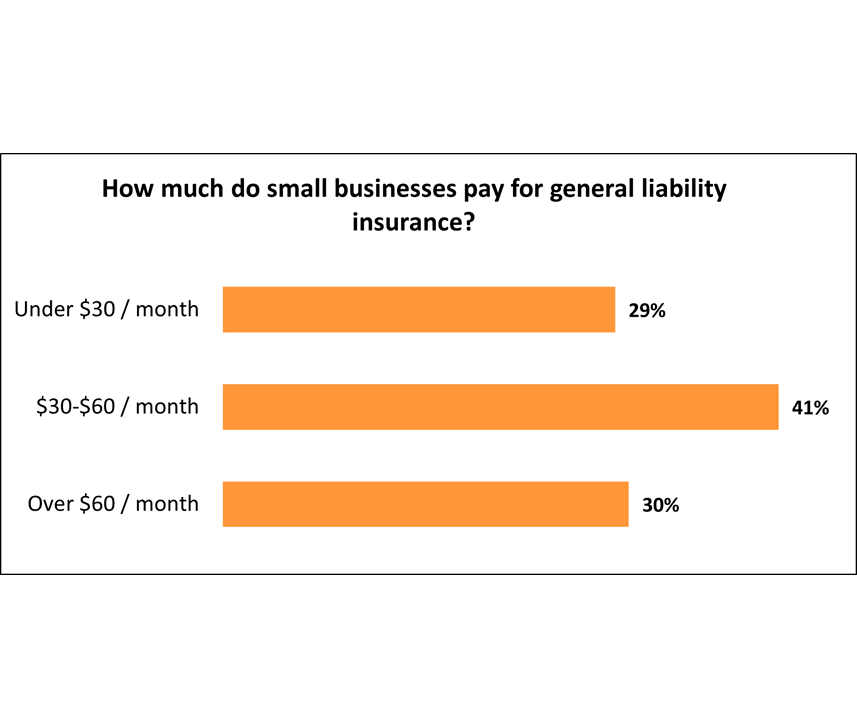

Business insurance premiums can be difficult to predict but you can ballpark your cost based on small business owners can use this data to estimate their cost of insurance.

Most small businesses with few or no employees can get properly insured from somewhere between $500 and $1,000, but it really depends on a multitude of.

The cost of business insurance can vary significantly from province and city.

A business in british columbia may need protections for earthquakes increasing the cost of property insurance.

The easiest way to find out how much business insurance will cost is to run a quick quote.

And since businesses come in all shapes and sizes, so does insurance, and it's difficult to give a straightforward answer to the question, how much does small business insurance cost?

Many businesses now opt for business insurance and it is now very easy for companies to estimate the business insurance cost as there is data provided on the internet by every insurance provider.

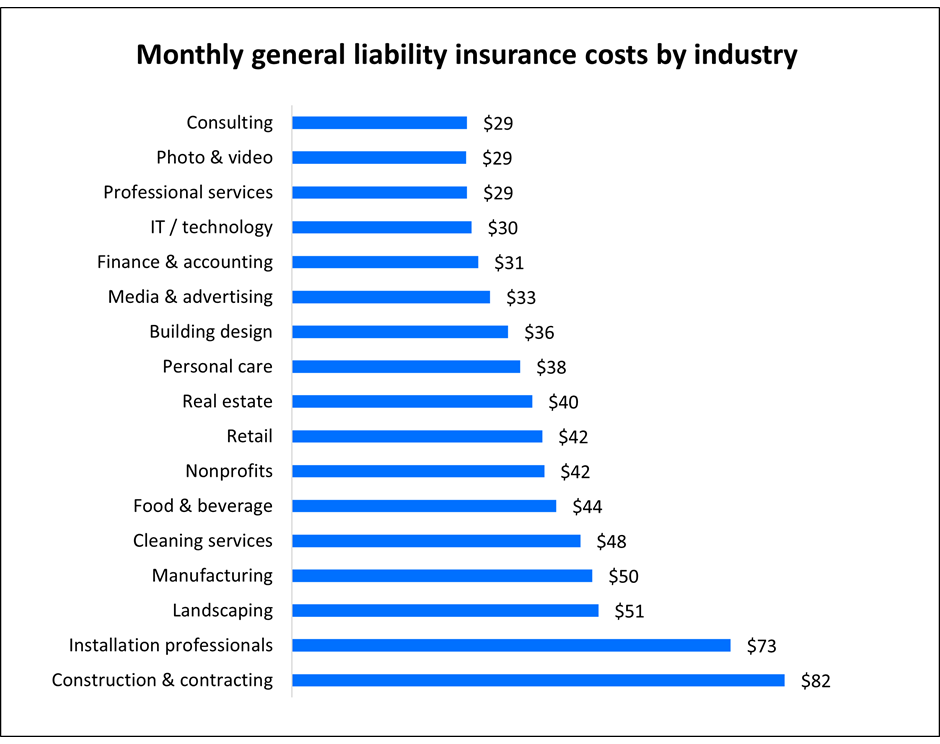

One key differentiator is the industry.

Different industries have different risk profiles, so national insurance carriers vary on the industries.

The average cost that a business owner may pay for insurance depends on various factors.

Business insurance can get expensive.

If you own a business (or you're thinking about starting a business) you're probably wondering how much business insurance costs.

How much does small business health insurance cost business owners?

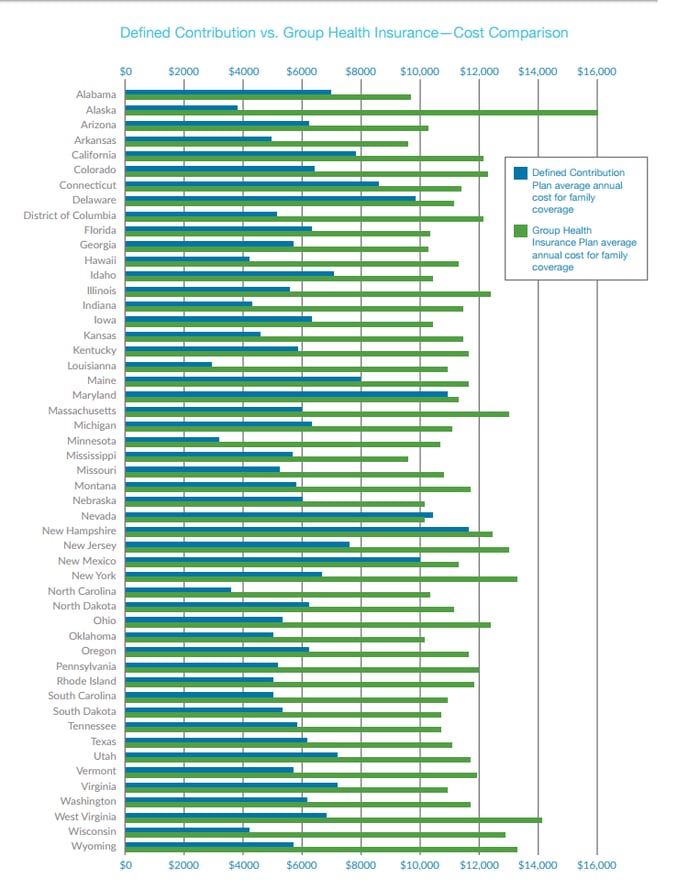

Business insurance costs by state.

Requirements vary from state to state, and that is why you need a personalized insurance quote and get in touch with a professional company.

Business insurance is a blanket term for the multiple types of insurance a business needs to protect its employees and its assets.

Asking what business insurance costs is kind of like asking how much it costs to buy a house on earth.

There are so many variables that influence the price.

Learn about small business insurance requirements, costs and coverages including:

How much does business insurance cost?

The cost of insurance for your business ultimately depends upon a few factors.

You'll need to consider the nature of your business, the risks involved.

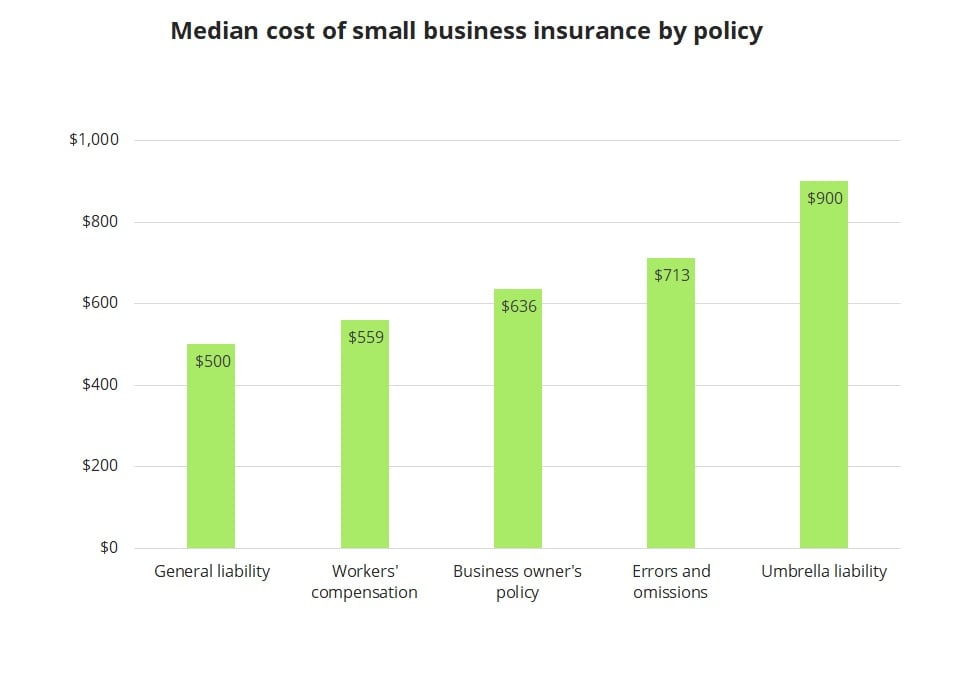

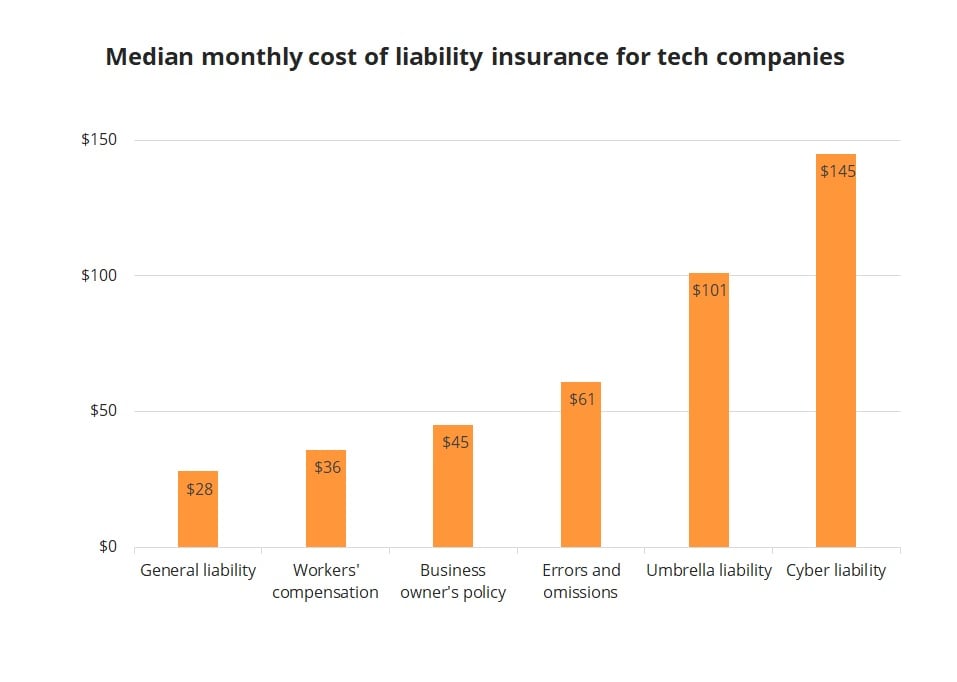

The cost of small business liability insurance primarily depends on which policies you buy.

The most common policy, general liability insurance, has an average cost of $28 per month.

Mulai Sekarang, Minum Kopi Tanpa Gula!!Ini Efek Buruk Overdosis Minum KopiAwas!! Ini Bahaya Pewarna Kimia Pada Makanan6 Khasiat Cengkih, Yang Terakhir Bikin HebohAwas!! Nasi Yang Dipanaskan Ulang Bisa Jadi `Racun`Obat Hebat, Si Sisik Naga4 Titik Akupresur Agar Tidurmu Nyenyak10 Manfaat Jamur Shimeji Untuk Kesehatan (Bagian 2)Ternyata Tidur Terbaik Cukup 2 Menit!Ternyata Inilah HOAX Terbesar Sepanjang MasaGet customized small business insurance to protect your business and employees. Business Insurance Cost. Replacement cost coverage pays for the cost of rebuilding, repairing or replacing your business's property as new.

Cover designed to help protect your business from unplanned costs when things go wrong.

How much does business insurance cost?

Business insurance is a packaged solution designed to protect your business from property, business and cyber liability insurance is a type of business insurance product, which protects your business against both the legal costs and expenses.

The cost of insurance for your business ultimately depends upon a few factors.

Have you previously had to make insurance claims regarding your business?

Business interruption or loss of profits insurance covers you if your business suffers from damage to professional indemnity insurance helps cover the cost of legal action due to your professional advice.

Learn about registering for and managing workcover insurance.

You'll be all sorted in no time.

Start your online quote for business read specific requirements here.

How much does business insurance cost?

Business insurance is designed to protect your business and its assets against liability and unexpected events.

For example, if a fire damaged your office and you were no longer able to host clients on the premises, it can include cover for the cost to repair the damage.

Tailor your cover with our range of business insurance and public liability insurance policies.

How much will suitable public liability insurance cost your business in australia?

Call 1300 670 250 or click for low cost cover!

Aami business insurance is trusted by 60,000 australian businesses.

How much does business insurance cost?

The price of business insurance will differ depending on when taking out business insurance, it's a good idea to consider the biggest risk factors you should insure furthermore, some business insurance policies are legal requirements in australia.

How business insurance costs are calculated.

Depending on the type of operation you run.

Business insurance protects your business assets so that if the business has a loss additional increased cost of working.

Covers costs associated with avoiding or diminishing a reduction berkley insurance australia underwrites a significant portfolio of general insurance business in australia.

238317 arranges this insurance as agent for the insurer allianz australia.

Public liability insurance protects you and your business against the legal costs of a claim for personal injury or damage to the property of others that occurs as a result of your business activities, either at your workplace or another location.

We provide comprehensive commercial insurance for australian businesses of all sizes.

Business insurance specialists in melbourne covering all industries such as manufacturing, office, industrial, importing & retail.

Business insurance is essential for your company.

You have invested a lot of time and money to get your business to where it is today.

Get a quote for the type of business insurance that's right for you, including coverage for your commercial or rideshare vehicle.

Two coverages you need, combined in a single policy.

See why businesses trust geico to help them with their business insurance needs with coverage for

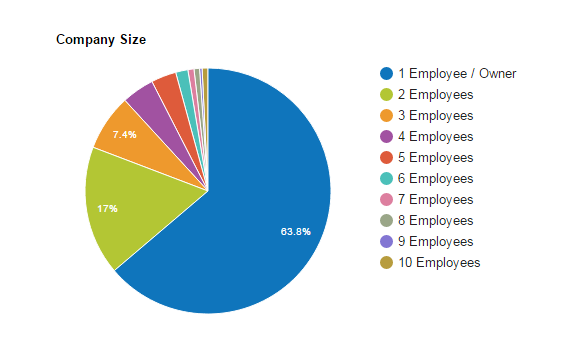

Carriers small business owners can get a good idea of the average cost of business insurance by looking at pricing data from the thousands of businesses.

Cover for your business' physical assets, from stock and machinery to your comprehensive protection in a broad range of scenarios, including fire, accidental and criminal damage and the cost of interruption to your business.

Understand the average business insurance cost to expect from each company.

Be more informed about the different commercial insurance types and which ones are right for your business.

The three main types of business liability insurance cover legal costs and any successful.

A family of four will pay around twice as much as a solo traveller.

Australia's insurance market can be divided into roughly three components:

Life insurance, general insurance and health insurance.

These markets are fairly distinct, with most larger insurers focusing on only one type.

Every insurance provider has their website where they provide different quotes according to different.

The cost of business insurance for startups varies considerably based on your industry, details of your business, and coverage.

By understanding the cost of business insurance for startups and determining the needs of your company at each development stage, you can assemble a policy that.

Industry type, public visibility, business location and other factors may also contribute to the cost of business insurance.

Typically, riskier businesses pay more for business insurance.

The average cost of renter's insurance is about $15 per month, but how much renters insurance could cost varies by your location and coverage amount.

Login contact us australia new zealand.

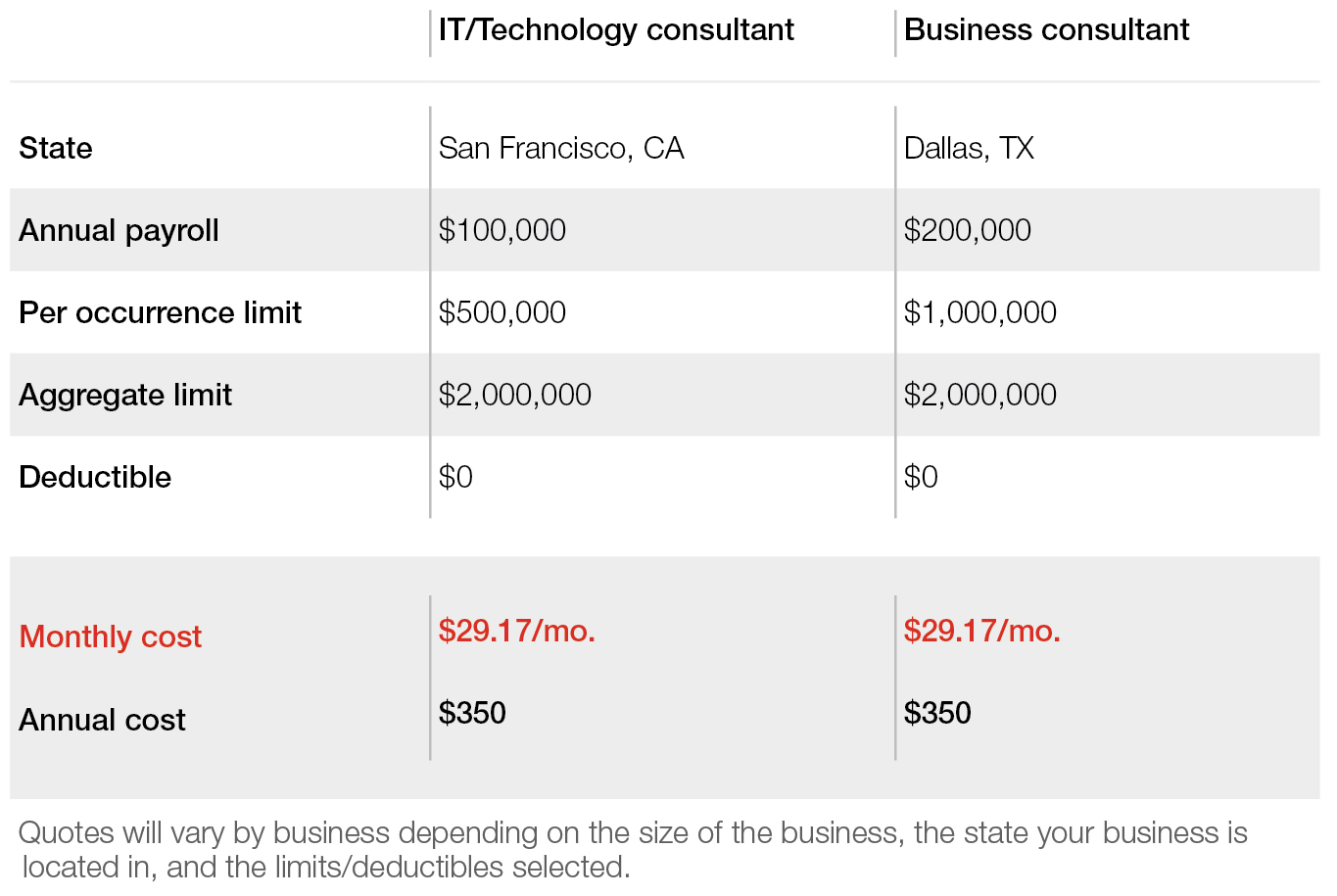

How much does professional liability insurance cost?

How much does professional liability insurance cost? Business Insurance Cost. Nevertheless, more than a third of small business owners pay less than $600 per year for their professional liability insurance coverage.9 Jenis-Jenis Kurma TerfavoritTernyata Asal Mula Soto Bukan Menggunakan DagingIni Beda Asinan Betawi & Asinan BogorResep Stawberry Cheese Thumbprint CookiesResep Ramuan Kunyit Lada Hitam Libas Asam Urat & RadangBakwan Jamur Tiram Gurih Dan NikmatResep Selai Nanas HomemadeSensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanTrik Menghilangkan Duri Ikan BandengTips Memilih Beras Berkualitas

Komentar

Posting Komentar