Business Insurance Cost Commercial General Liability, Commercial Property Insurance, Workers Compensation, Business Owner's Policy.

Business Insurance Cost. But The Cost Of Business Insurance Is Usually Driven Up By Your Business Liability Cover:

SELAMAT MEMBACA!

How much does small business insurance cost?

How business insurance costs are calculated.

The insurance company's number crunchers start simply put, the cost of your insurance will depend on what your business does and how much of it.

Get a quote for the type of business insurance that's right for you, including coverage for whether you're a small business just getting started or just looking for better insurance rates, geico can help.

The cost of public liability insurance ranges from £50 to £500 for a small business, and depends on factors like.

Business insurance costs can vary greatly based on the type of business you own.

Industry type, public visibility, business location and other factors may also contribute to the cost of business.

Rates start at $50 monthly for.

Compare online & save in few simple steps 2.

How much does business insurance cost.

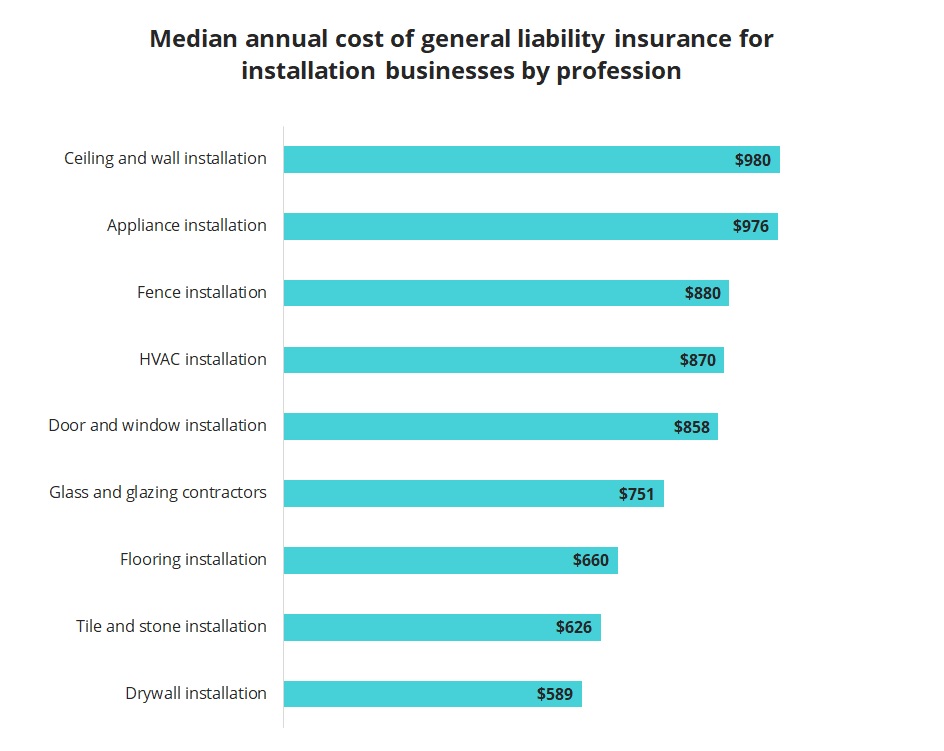

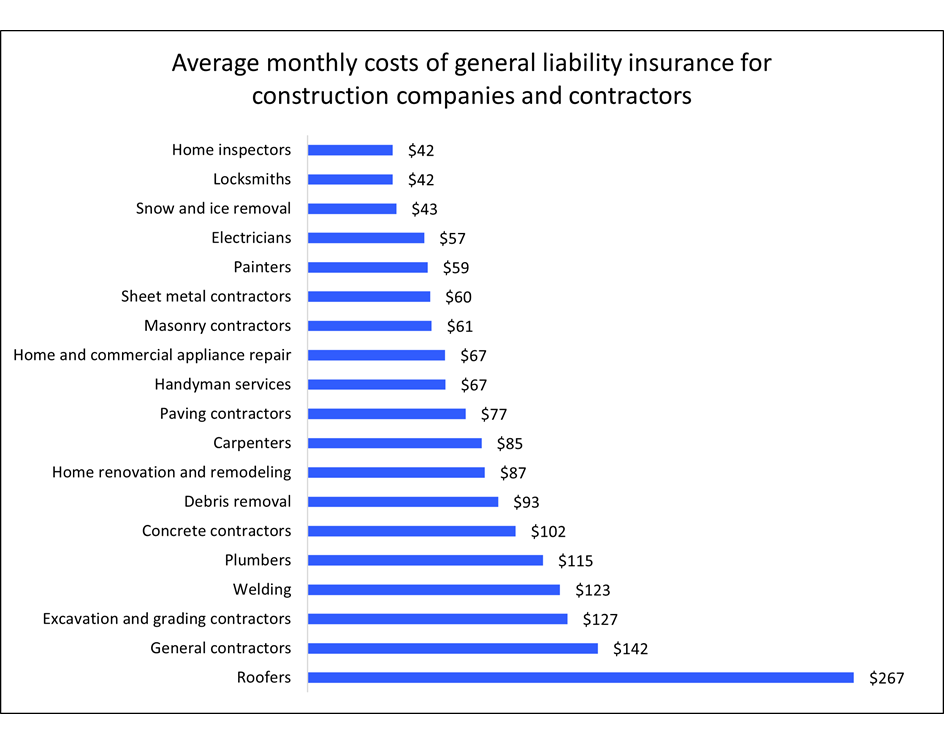

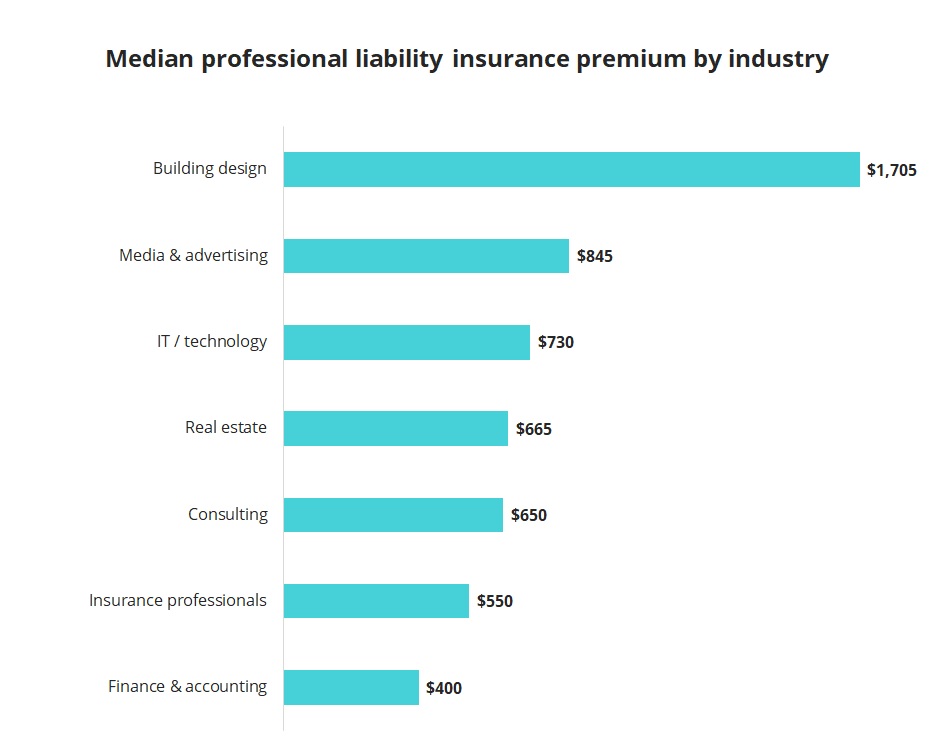

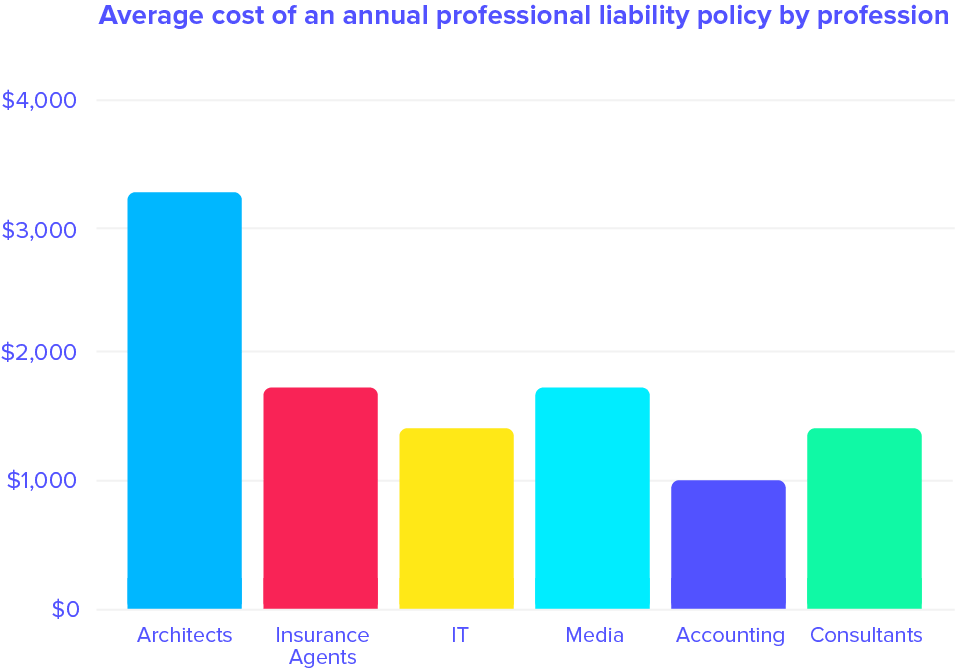

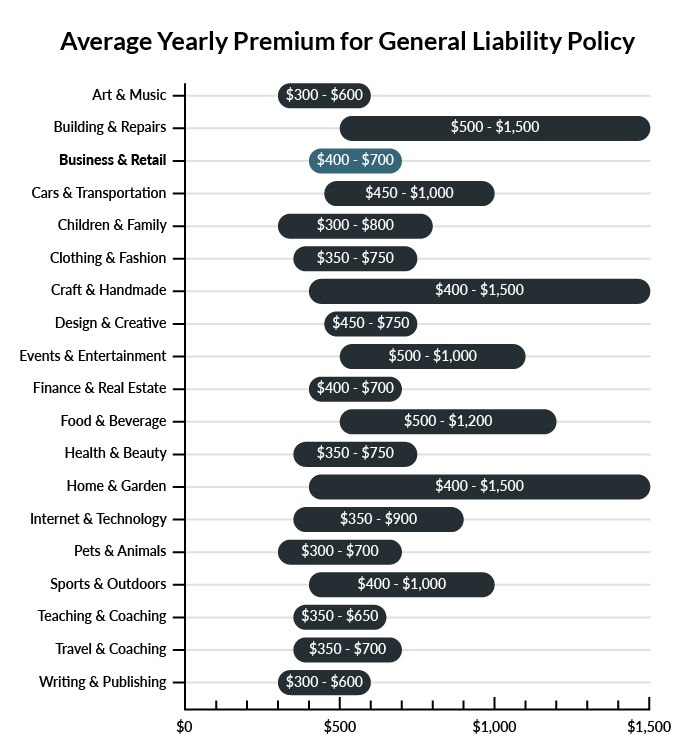

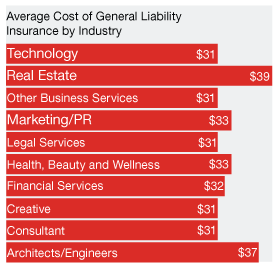

Average cost of business insurance by profession.

The cost of business insurance can be affected by a few different things.

Let's go over each of the most prominent factors in business.

Here's what you need to know before you purchase insurance.

Tailor your business insurance to meet your needs.

With axa, get cover as unique as your so as you might expect, the cost of your business insurance will be unique too.

But the cost of business insurance is usually driven up by your business liability cover:

Covers your business in case any current or previous employees become injured.

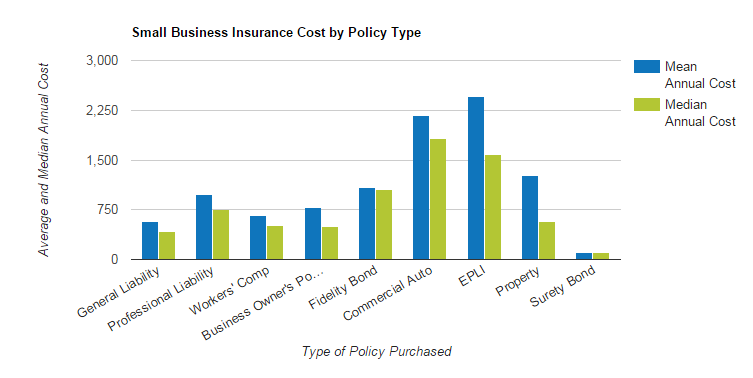

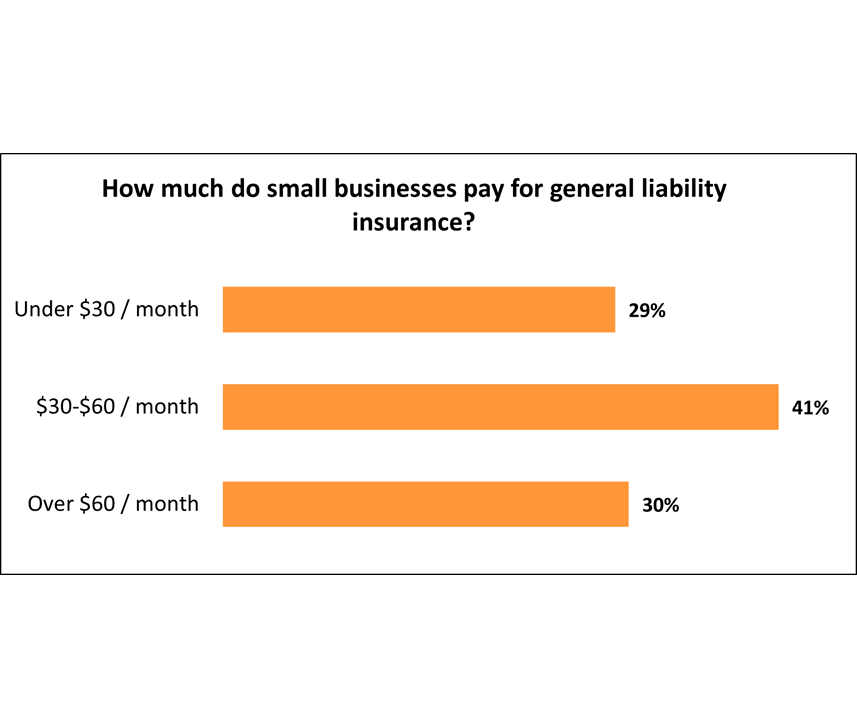

Business insurance premiums can be difficult to predict but you can ballpark your cost based on small business owners can use this data to estimate their cost of insurance.

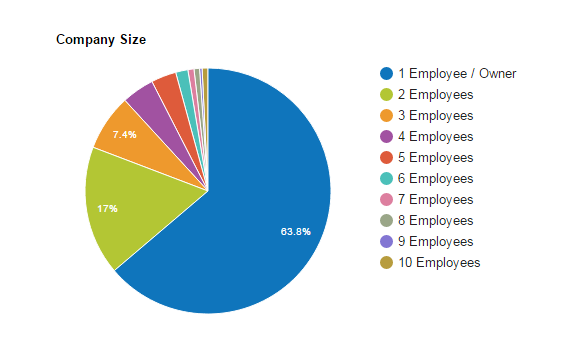

Most small businesses with few or no employees can get properly insured from somewhere between $500 and $1,000, but it really depends on a multitude of.

The cost of business insurance can vary significantly from province and city.

A business in british columbia may need protections for earthquakes increasing the cost of property insurance.

The easiest way to find out how much business insurance will cost is to run a quick quote.

And since businesses come in all shapes and sizes, so does insurance, and it's difficult to give a straightforward answer to the question, how much does small business insurance cost?

Many businesses now opt for business insurance and it is now very easy for companies to estimate the business insurance cost as there is data provided on the internet by every insurance provider.

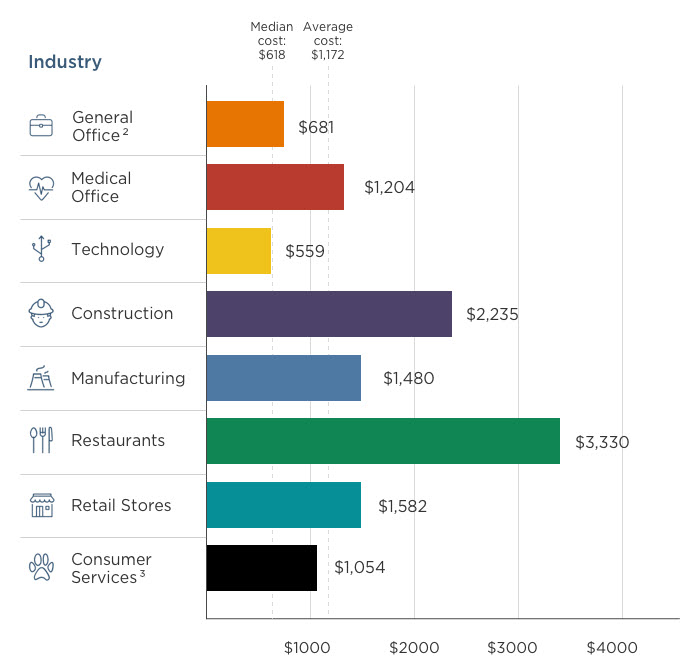

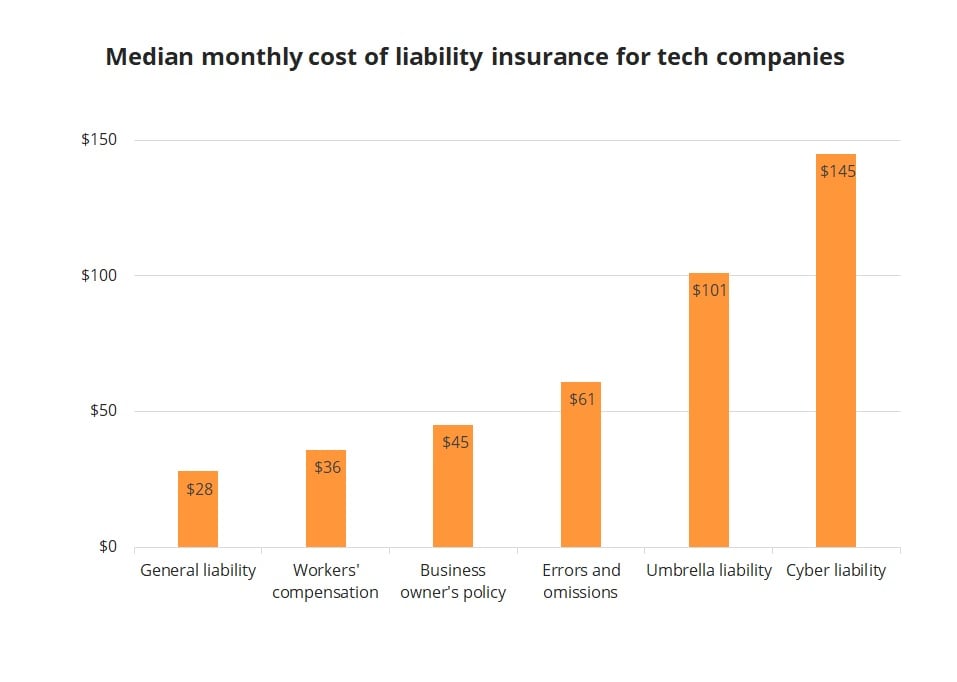

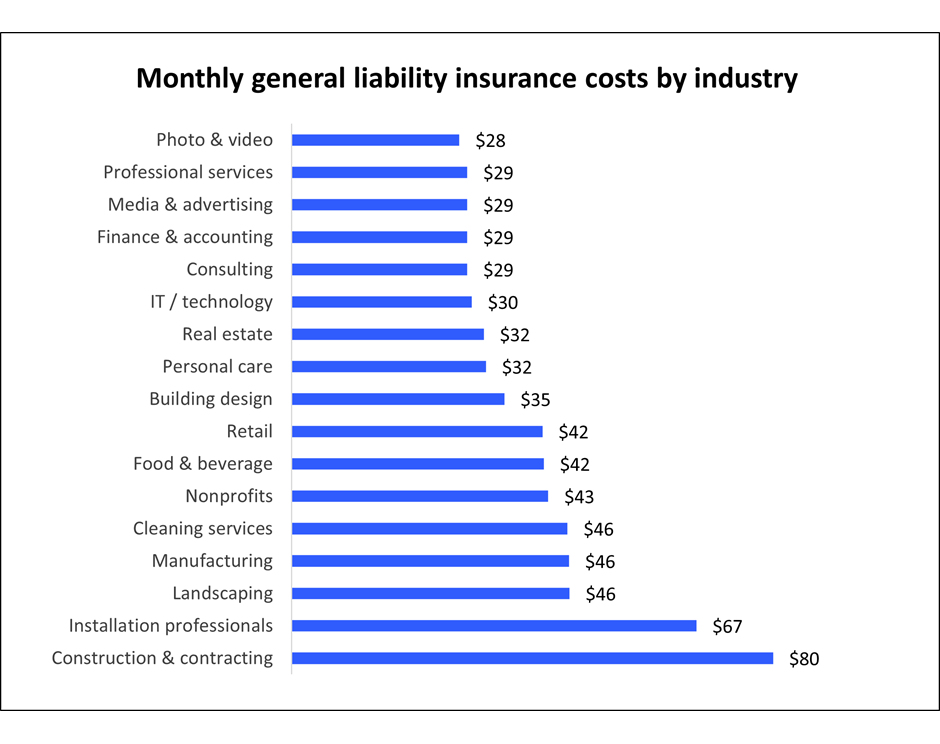

One key differentiator is the industry.

Different industries have different risk profiles, so national insurance carriers vary on the industries.

The average cost that a business owner may pay for insurance depends on various factors.

Business insurance can get expensive.

If you own a business (or you're thinking about starting a business) you're probably wondering how much business insurance costs.

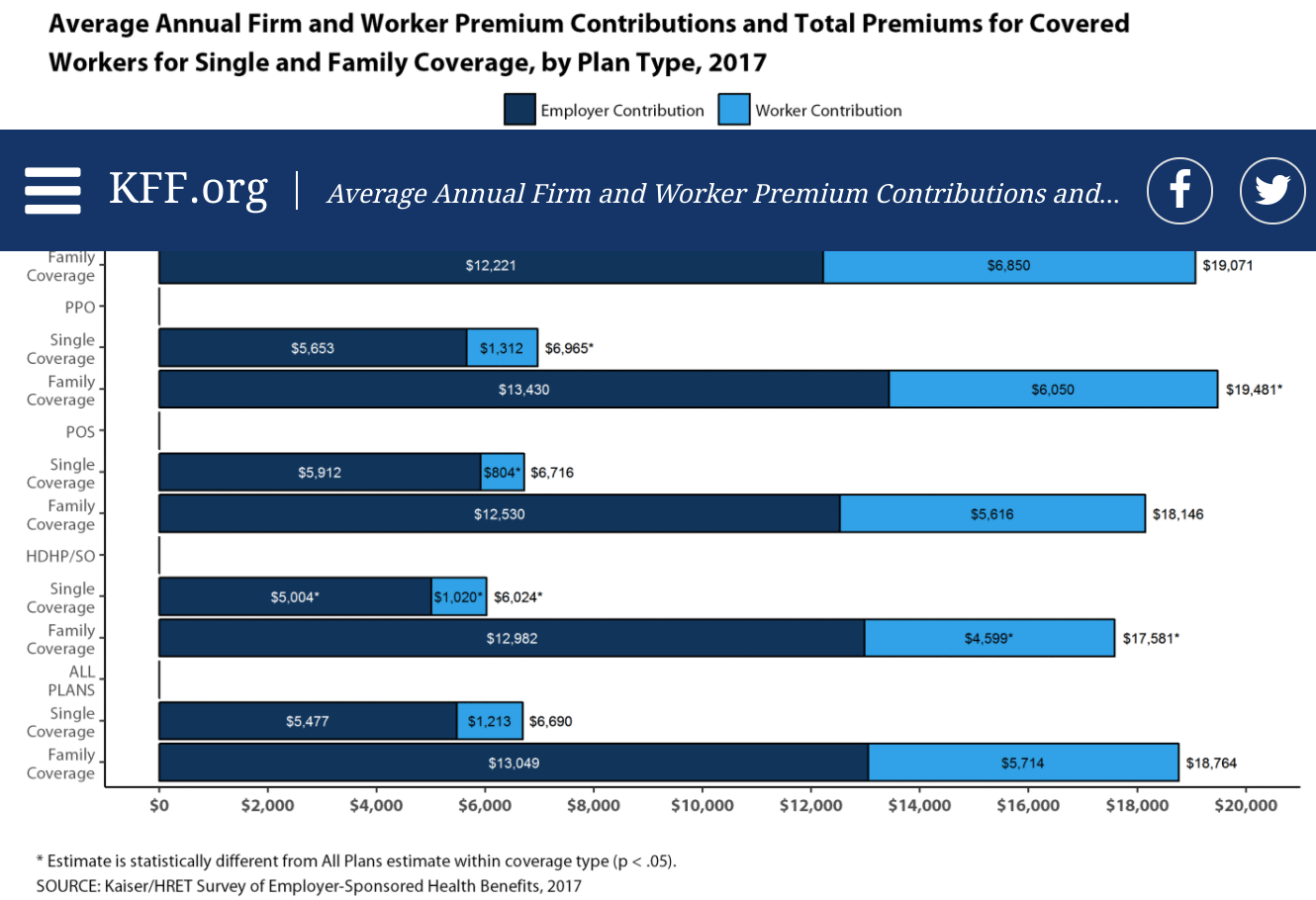

How much does small business health insurance cost business owners?

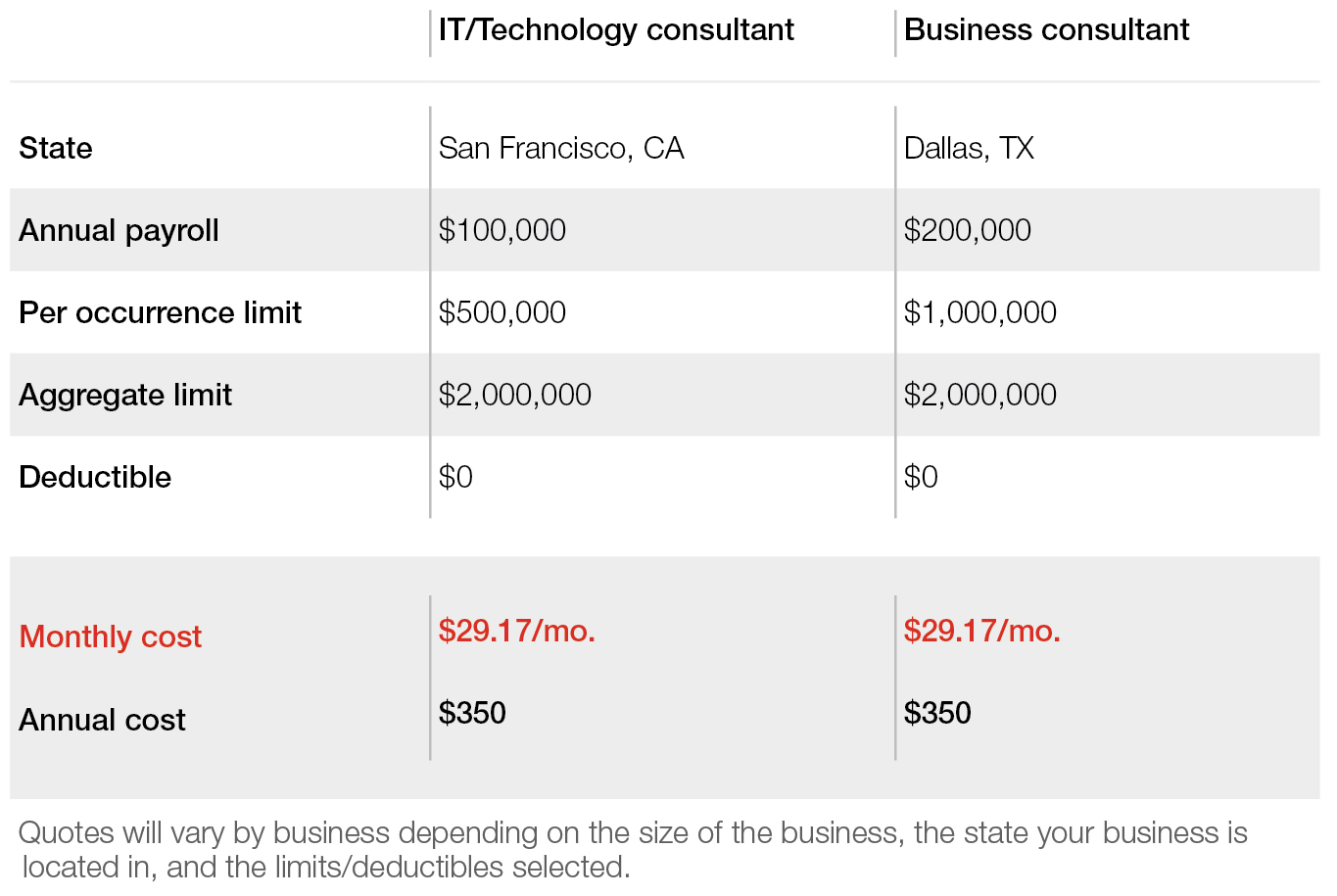

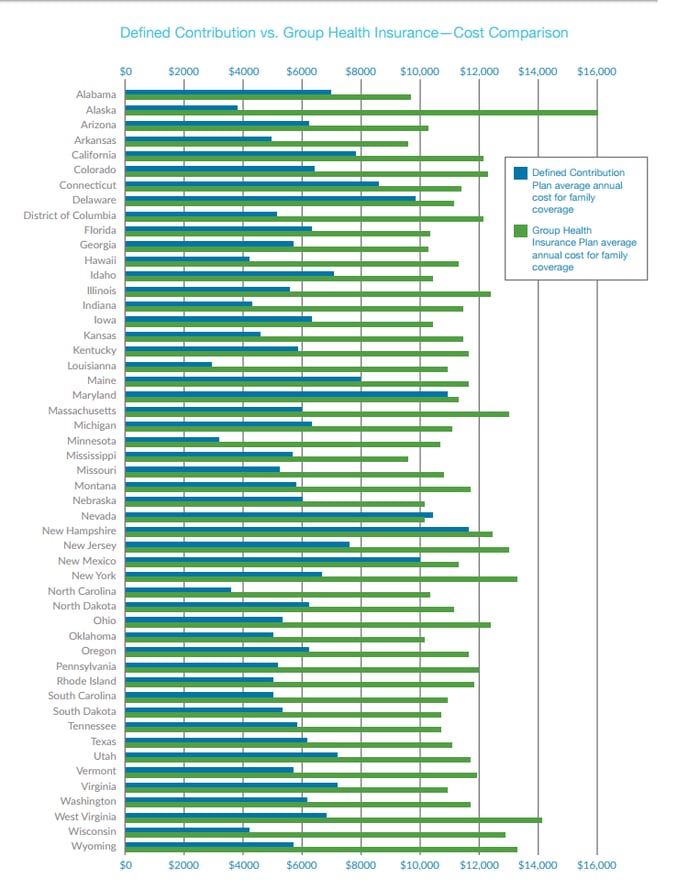

Business insurance costs by state.

Requirements vary from state to state, and that is why you need a personalized insurance quote and get in touch with a professional company.

Business insurance is a blanket term for the multiple types of insurance a business needs to protect its employees and its assets.

Asking what business insurance costs is kind of like asking how much it costs to buy a house on earth.

There are so many variables that influence the price.

Learn about small business insurance requirements, costs and coverages including:

How much does business insurance cost?

The cost of insurance for your business ultimately depends upon a few factors.

You'll need to consider the nature of your business, the risks involved.

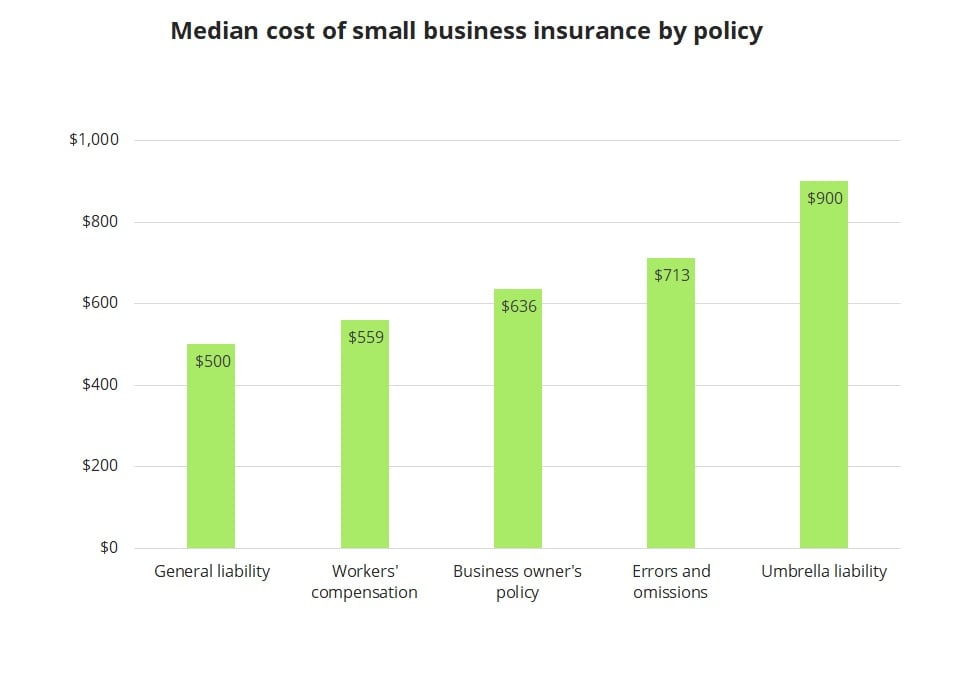

The cost of small business liability insurance primarily depends on which policies you buy.

The most common policy, general liability insurance, has an average cost of $28 per month.

Ternyata Jangan Sering Mandikan Bayi4 Titik Akupresur Agar Tidurmu NyenyakCegah Celaka, Waspada Bahaya Sindrom HipersomniaFakta Salah Kafein KopiPD Hancur Gegara Bau Badan, Ini Solusinya!!Tips Jitu Deteksi Madu Palsu (Bagian 2)4 Manfaat Minum Jus Tomat Sebelum TidurTernyata Tidur Bisa Buat Meninggal8 Bahan Alami Detox Saatnya Bersih-Bersih UsusGet customized small business insurance to protect your business and employees. Business Insurance Cost. Replacement cost coverage pays for the cost of rebuilding, repairing or replacing your business's property as new.

How much does small business insurance cost?

How business insurance costs are calculated.

The insurance company's number crunchers start simply put, the cost of your insurance will depend on what your business does and how much of it.

Get a quote for the type of business insurance that's right for you, including coverage for whether you're a small business just getting started or just looking for better insurance rates, geico can help.

The cost of public liability insurance ranges from £50 to £500 for a small business, and depends on factors like.

Business insurance costs can vary greatly based on the type of business you own.

Industry type, public visibility, business location and other factors may also contribute to the cost of business.

Rates start at $50 monthly for.

Compare online & save in few simple steps 2.

How much does business insurance cost.

Average cost of business insurance by profession.

The cost of business insurance can be affected by a few different things.

Let's go over each of the most prominent factors in business.

Here's what you need to know before you purchase insurance.

Tailor your business insurance to meet your needs.

With axa, get cover as unique as your so as you might expect, the cost of your business insurance will be unique too.

But the cost of business insurance is usually driven up by your business liability cover:

Covers your business in case any current or previous employees become injured.

Business insurance premiums can be difficult to predict but you can ballpark your cost based on small business owners can use this data to estimate their cost of insurance.

Most small businesses with few or no employees can get properly insured from somewhere between $500 and $1,000, but it really depends on a multitude of.

The cost of business insurance can vary significantly from province and city.

A business in british columbia may need protections for earthquakes increasing the cost of property insurance.

The easiest way to find out how much business insurance will cost is to run a quick quote.

And since businesses come in all shapes and sizes, so does insurance, and it's difficult to give a straightforward answer to the question, how much does small business insurance cost?

Many businesses now opt for business insurance and it is now very easy for companies to estimate the business insurance cost as there is data provided on the internet by every insurance provider.

One key differentiator is the industry.

Different industries have different risk profiles, so national insurance carriers vary on the industries.

The average cost that a business owner may pay for insurance depends on various factors.

Business insurance can get expensive.

If you own a business (or you're thinking about starting a business) you're probably wondering how much business insurance costs.

How much does small business health insurance cost business owners?

Business insurance costs by state.

Requirements vary from state to state, and that is why you need a personalized insurance quote and get in touch with a professional company.

Business insurance is a blanket term for the multiple types of insurance a business needs to protect its employees and its assets.

Asking what business insurance costs is kind of like asking how much it costs to buy a house on earth.

There are so many variables that influence the price.

Learn about small business insurance requirements, costs and coverages including:

How much does business insurance cost?

The cost of insurance for your business ultimately depends upon a few factors.

You'll need to consider the nature of your business, the risks involved.

The cost of small business liability insurance primarily depends on which policies you buy.

The most common policy, general liability insurance, has an average cost of $28 per month.

Get customized small business insurance to protect your business and employees. Business Insurance Cost. Replacement cost coverage pays for the cost of rebuilding, repairing or replacing your business's property as new.Sensasi Kholaqul Ayyam Gumeno, Hanya Ada Saat RamadhanSejarah Gudeg JogyakartaWaspada, Ini 5 Beda Daging Babi Dan Sapi!!5 Trik Matangkan Mangga5 Makanan Pencegah Gangguan PendengaranKuliner Jangkrik Viral Di JepangResep Stawberry Cheese Thumbprint CookiesSegarnya Carica, Buah Dataran Tinggi Penuh KhasiatTernyata Kue Apem Bukan Kue Asli IndonesiaResep Ayam Kecap Ala CeritaKuliner

Komentar

Posting Komentar